child tax credit 2021 dates and amounts

The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. The Child Tax Credit.

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Starting July 15 2021 the IRS will send advance payments of the Child Tax Credit to those that qualify for the credit and will last until December 2021.

. Advance Child Tax Credit. Tax season is far from over. The first phaseout reduces the Child Tax Credit by 50 for each 1000 or fraction thereof by which the taxpayers modified AGI exceeds the income amounts above.

Here are the official dates. Individuals that make less than 12550 and married couples that make less than 25100 can file through. 13 opt out by Aug.

It will not be reduced. To get the full enhanced CTC which amounts to 3600 for children under 6 years old and 3000 for kids ages 6 to 17 years old single taxpayers must earn less than. The Child Tax Credit and Earned Income Tax Credit.

2021 child tax credit This year the Martins and the Longs are eligible for the same 9000 child tax credit. The maximum annual Child Tax Credit rates are shown below. If your AFNI is under 32797 you get the maximum amount for each child.

The payments will be made either by direct deposit or by paper check depending on what. First the credit amount was temporarily increased from 2000 per child to. New 2021 Child Tax Credit and advance payment details.

Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022. You get to claim the lesser of 15 of your earned income above 2500 or your unused Child Tax Credit amount up to 1400 per qualifying child. Year 2021 -CTC Refund Rules.

The tool below is to only be used to help you determine what your 2021. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. The two most significant changes impact the credit amount and how parents receive the credit.

Child Tax Credit family element. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. Child Tax Credit amounts will be different for each family.

The amount of credit you receive is based. The credit amounts will increase for many. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. The Hills are eligible for less money than the other families because. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

It also provided monthly payments from July of 2021 to. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. Visit ChildTaxCreditgov for details.

Your amount changes based on the age of your. 15 opt out by Aug. 6997 per year 58308 per month 6 to 17 years of age.

Rates per year 2022 to 2023. To get the first cost of living payment of 326 you must have been entitled or later found to be. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

Child tax credit payments will revert to 2000 this year for eligible taxpayers credit. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self. Under 6 years of age.

Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

2020 Tax Filing Will Determine Child Tax Credit Periodic Payments In 2021 Early Childhood Alliance

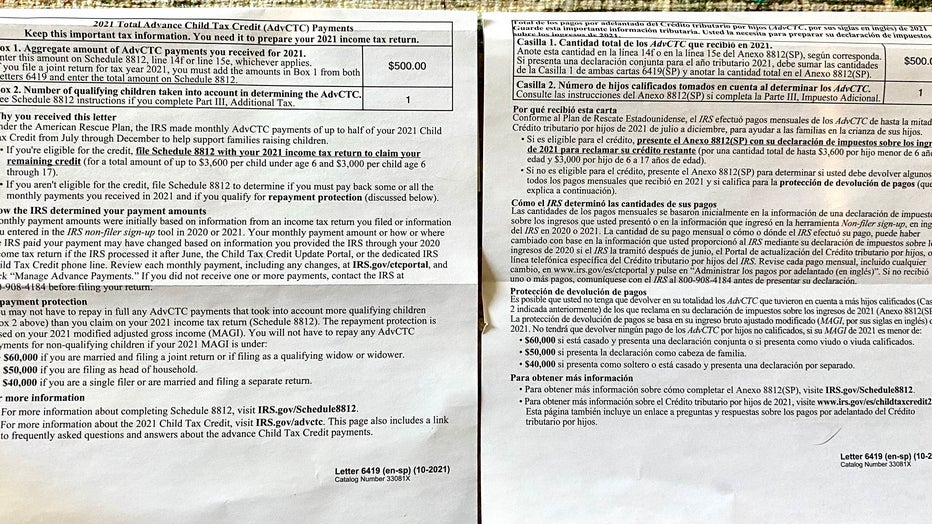

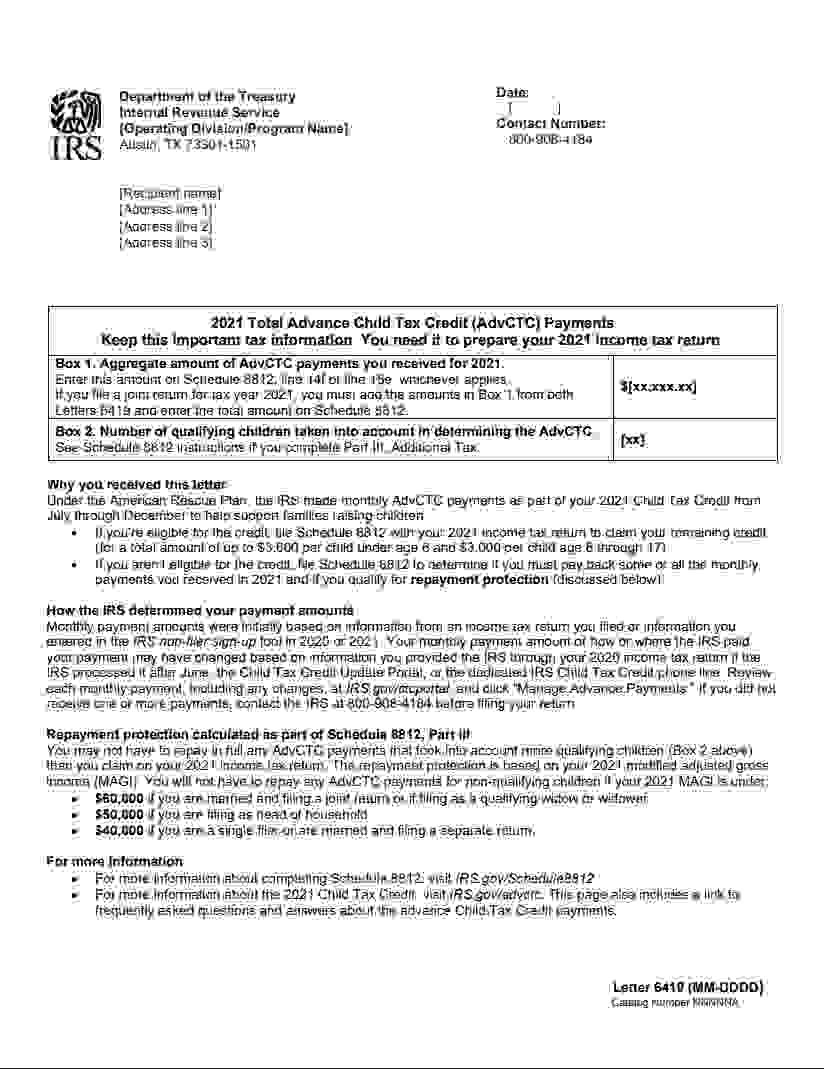

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Inworks Tax Services Advanced Child Tax Credit Ctc Payments In 2021 The First Monthly Payment Of The Expanded And Newly Advanceable Ctc Will Be Made On July 15 Eligible Families Are Slated

Advance Child Tax Credit Filing Confusion Cleared Up

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

Irs Warns Parents Not To Toss Important Tax Document

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Advance Payments Of The Child Tax Credit I M Definitely Eligible Why Does It Says I M Not R Irs

Here Is Why You May Want To Opt Out Of Child Tax Credit Early Payments

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kdbc

Child Tax Credit Update Missed First Payment Youtube

/cloudfront-us-east-1.images.arcpublishing.com/gray/KG7MSHRCMFD4FOM63245ZQLFX4.png)

Bigger Child Tax Credit Checks Coming Early This Year

Child Tax Credit 2022 You Might Have Received An Incorrect 6419 Letter Irs Warns Lee Daily

Will You Have To Repay The Advanced Child Tax Credit Payments Wkbn Com

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities